- The stock drop was triggered by Intel's Q4 2025 earnings report, which included first-quarter 2026 revenue and profit guidance that fell short of analyst expectations.

- Intel reported a net loss of $600 million, or 12 cents per diluted share, for the quarter.

- The company cited struggles to meet the high demand for its server chips used in AI data centers, indicating supply constraints are weighing on its turnaround efforts.

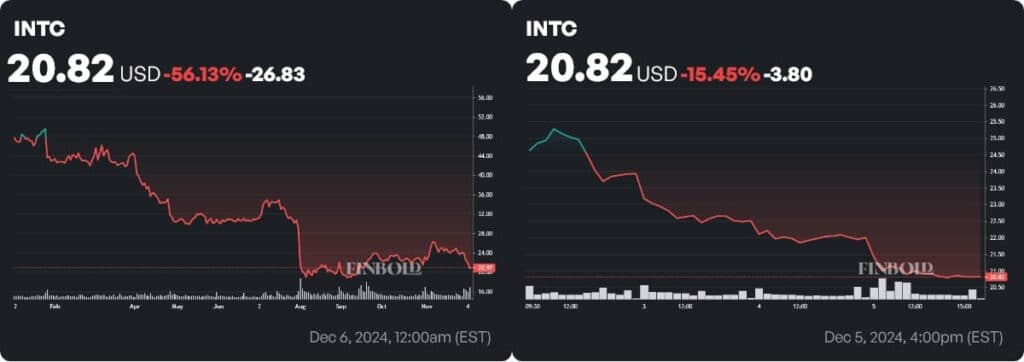

- The 13% drop in after-hours trading and at the open is the largest single-day slide since the catastrophic August 2024 earnings report, which saw shares plummet 26%.

- Analysts are concerned about the yield and ramp-up of Intel's new 18A and upcoming 14A process nodes, which are critical to its long-term foundry strategy.

Intel shares plunge 13% after forecasting first-quarter revenue below market estimates

Jan 23, 2026, 2:32:58 PM UTC(11 days ago)

Impact: High

Affected Assets

Sources

From:@DeItaone

INTEL SHARES SLIDE 14% AT THE OPEN, MOST SINCE AUGUST 2024